1. Cars and some motorhomes registered on or after 1 April 2017

You’ll pay a rate based on a vehicle’s CO2 emissions the first time it’s registered. This applies to:- cars

- some motorhomes

Your motorhome’s included if both the following apply:

- it’s in the M1SP category - check with your dealer if you’re not sure

- its CO2 emissions are included on the ‘type approval certificate’ (this might be called a ‘certificate of conformity’ or ‘individual vehicle approval’)

If you have a different kind of motorhome, you pay tax in a different way. https://www.gov.uk/vehicle-tax-rate-tables/other-vehicle-tax-rates

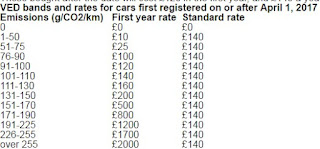

First tax payment when you register the vehicle

| CO2 emissions (g/km) | Petrol (TC48) and diesel cars (TC49) | Alternative fuel cars (TC59) |

|---|---|---|

| 0 | £0 | £0 |

| 1 - 50 | £10 | £0 |

| 51 - 75 | £25 | £15 |

| 76 - 90 | £100 | £90 |

| 91 - 100 | £120 | £110 |

| 101 - 110 | £140 | £130 |

| 111 - 130 | £160 | £150 |

| 131 - 150 | £200 | £190 |

| 151 - 170 | £500 | £490 |

| 171 - 190 | £800 | £790 |

| 191 - 225 | £1,200 | £1,190 |

| 226 - 255 | £1,700 | £1,690 |

| Over 255 | £2,000 | £1,990 |

Rates for second tax payment onwards

| Fuel type | Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly payments by Direct Debit | Single 6 month payment | Single 6 month payment by Direct Debit |

|---|---|---|---|---|---|

| Petrol or diesel | £140 | £140 | £147 | £77 | £73.50 |

| Electric | £0 | £0 | £0 | £0 | £0 |

| Alternative | £130 | £130 | £136.50 | £71.50 | £68.25 |

Vehicles with a list price of more than £40,000

You have to pay an extra £310 a year if you have a car or motorhome with a ‘list price’ (the published price before any discounts) of more than £40,000.

You only have to pay this rate for 5 years (from the second time the vehicle is taxed).

Above is a new DVLA car tax rules that took effect in April, will end up with costs motorist hundreds of pounds extra a year. After that, the tax that is paid depending on the type of vehicle. For vehicle petrol or diesel standards, this is a fixed cost of £140 a year. Cars ' alternative-fueled '-hybrid, or powered by LPG bioetanol-now only £10 cheaper at a price of £130 a year, while in the first year of a car with zero emissions remain free of tax. Tax rates for vehicles registered before 1 April 2017, will not be affected by this change.

Check the list price with your dealer so you know how much vehicle tax you’ll have to pay.

| Fuel type | Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly payments by Direct Debit | Single 6 month payment | Single 6 month payment by Direct Debit |

|---|---|---|---|---|---|

| Petrol or diesel | £450 | £450 | £472.50 | £247.50 | £236.25 |

| Electric | £310 | £310 | £325.50 | £170.50 | £162.75 |

| Alternative | £440 | £440 | £462 | £242 | £231 |

0 komentar:

Post a Comment